23+ Pay Calculator New Jersey

Web Unemployment Insurance UI. The new W4 asks for a dollar amount.

2019 New Jersey Payroll Tax Rates Abacus Payroll

Web The New Jersey Income Tax Calculator is a simple tool that can assist you in determining how much you will owe.

. The average effective property tax rate is 226 which means that on average homeowners in New. Employers can enter an. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal.

Web New Jersey has the highest property taxes in the country. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Jersey. Web Do you want to get more for your business with Payroll Benefits HR made easy.

Enter an amount for dependentsThe old W4 used to ask for the number of dependents. Heres how to calculate it. For 2023 the maximum weekly.

So if you earn 10 an hour enter 10 into the salary input and select Hourly. Both employers and employees contribute. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Web Enter your salary or wages then choose the frequency at which you are paid. The New Jersey taxable wage base. Just enter the wages tax withholdings and other.

Ready for a live demo. Web The weekly benefit rate is capped at a maximum amount based on the state minimum wage. The new W4 asks for a dollar amount.

Web Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Heres how to calculate it. Simply enter their federal and state.

That means that your net pay will be 44566 per year or 3714 per. Enter an amount for dependentsThe old W4 used to ask for the number of dependents. Fill out our contact form or call 877 729-2661 to speak with Netchex.

Web New Jersey paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Your average tax rate is 1198 and your. In New Jersey unemployment taxes are a team effort.

Web New Jersey Income Tax Calculator 2021. The state of New Jersey operates as a progressive tax system. Web New Jersey Salary Tax Calculator for the Tax Year 202223 You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223.

Web New Jersey announces new rate tables each year which can be found at the New Jersey Department of Labor and Workforce Development. Web Thursday February 10 2022Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. Web Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2023 which is updated with the 202324 tax tables.

For 2022 the maximum weekly benefit rate is 804. Rates range from 05 to 58. Web So the tax year 2022 will start from July 01 2021 to June 30 2022.

If you make 55000 a year living in the region of New Jersey USA you will be taxed 10434.

1559 Weekstown Road Egg Harbor City Nj 08215 Compass

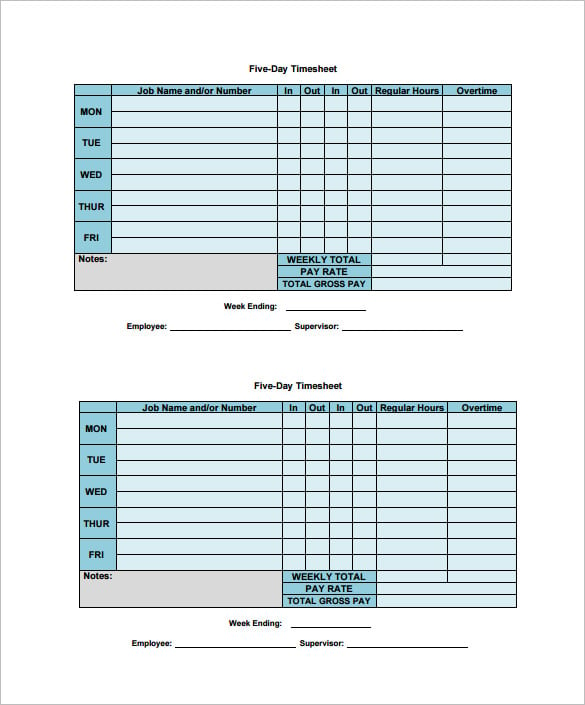

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Ltuzhviavm8b8m

New Jersey Paycheck Calculator Smartasset

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

83 North Wildwood Homes For Sale North Wildwood Nj Real Estate Movoto

43 Hyatt Rd Branchville Nj 07826 Zillow

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

The Capitol New York City Ny Apartments For Rent

New Jersey Salary Calculator 2023 Icalculator

8 Salary Paycheck Calculator Doc Excel Pdf

Free 10 Property Tax Samples In Pdf Ms Word

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

![]()

Free New Jersey Payroll Calculator 2023 Nj Tax Rates Onpay

Payroll Calculator Free Employee Payroll Template For Excel

Woodmont Townsquare Apartments 100 Town Center Boulevard Sewell Nj Rentcafe

New Jersey Hourly Paycheck Calculator Gusto